Why 90% of coliving companies will disappear (and what the survivors will look like)

Plus: Download my full coliving presentation from last year's Urban Living Middle East Conference

In September 2019, WeWork's IPO imploded, burning $47 billion in valuation practically overnight.

What many forget is that just months earlier, their coliving subsidiary WeLive was valued at $2.9 billion and poised for aggressive expansion.

Today, WeLive no longer exists.

And they won't be the last to vanish.

At the height of the coliving boom (2018-2021), more than $3.7 billion flowed into the sector. Investors were entranced by the vision of millennial-friendly communal living that promised both scale and profitability.

But the reality has proven far more complex.

In the past few years, we've unfortunately seen pioneers of coliving (The Collective, Common) go down.

The pandemic accelerated some trends, but it didn't cause the underlying problems.

It exposed them.

I've spent the last four years studying coliving models and, together with The Parklane Group (UK), created a coliving brand.

My conclusion is strong: By 2028, at least 90% of today's coliving operators will have disappeared.

But a resilient few will not only survive - they'll thrive. And they'll look nothing like what most people expect.

Today’s Brief:

The four coliving traps

What the 10% of survivors will look like

The coming consolidation wave

The actionable takeaways

The view from 2028

Business idea of the week: Coliving asset acquisition platform

The bottom line

The four coliving traps

1. The unit economics trap

The most critical misconception in coliving is thinking that density solves everything.

Many operators built financial models assuming they could charge a 20-30% premium over standard rentals by squeezing more beds into less space. The math seemed straightforward:

Take a 3-bedroom apartment that would rent for £3,000/month

Convert it to a 5-bedroom coliving unit

Charge £1,200 per room (£6,000 total)

Pocket the 100% uplift

But this fails to account for the complete picture.

Recent data shows that operational costs for coliving spaces can run 40% higher per square foot than traditional multifamily properties.

"Among surveyed operators, average operational expenses run 40% higher per square foot than traditional multifamily comparables, with property management staffing costs accounting for the largest differential (15-20% of revenue vs. 7-10% for traditional multifamily)."

Coliving’s Collaborative's Annual Industry Benchmark (2022)

Pioneering coliving players discovered this the hard way, with some locations barely breaking even despite 95%+ occupancy.

2. Scale Without Standardisation

WeWork's fundamental flaw wasn't its business model - it was trying to be Marriott without Marriott's operational discipline.

Coliving has fallen into the same trap.

Operators rush to claim they have 10,000+ units under management across dozens of cities, but behind the scenes, they're managing a patchwork of inconsistent properties:

Different building configurations

Varied amenity packages

Inconsistent furniture and fixtures

Location-specific partnership deals

Custom community programming

This lack of standardisation creates an operational nightmare that actively resists economies of scale.

Common has publicly discussed how they initially managed properties across different cities with vastly different designs, amenities, and local regulations. Brad Hargreaves has mentioned in interviews that they had to rebuild their operations team multiple times as they scaled from 10 to 100+ locations.

3. The Community Myth

"Community" is the most overused word in coliving marketing.

It's also the least understood.

The secret? Most residents don't want forced community as much as operators think.

A 2022 Global Coliving Report (The House Monk) surveyed 850+ coliving residents across North America, Europe, and Asia.

Their findings show the primary factors for choosing coliving were:

Location convenience (64%)

All-inclusive utility pricing (59%)

Flexible contracts (51%)

High-quality furnishings (48%)

Community activities ranked 5th at just 36%

This disconnect creates a brutal reality: operators invest heavily in community management that many residents don't value enough to pay for.

Yet, coliving companies continue to hire expensive community managers, organise costly events, and build elaborate digital platforms - all of which create overhead without proportional revenue.

4. The Capital Intensity Reality

The final trap is the most obvious, yet most ignored: real estate is capital intensive.

The Master Lease model (where operators lease rather than own buildings) was supposed to solve this, allowing coliving companies to scale like tech startups without real estate's capital requirements.

This approach has failed.

Master leases create fundamental misalignment between:

The operator's short-term lease obligations (3-10 years)

The significant upfront investment required

The time needed to reach profitability (typically 18-24 months per location)

When market conditions shift, this model collapses.

Rent obligations remain fixed while revenue fluctuates, creating negative cash flow that burns through capital at alarming rates.

What the 10% of survivors will look like

Not all is doom and gloom.

I believe a select few operators will not only survive, but transform the housing landscape. Here's what they'll have:

1. Technology-first, not community-first

Winning coliving companies will be tech companies that happen to operate real estate - not real estate companies with a tech veneer.

They are building proprietary operating systems that manage:

Automated leasing flows (reducing acquisition costs by 60-70%)

Smart access control and security

Dynamic pricing algorithms that optimise yield

Predictive maintenance systems

Digital resident experiences that require minimal human intervention

This shift from high-touch to high-tech will transform staff roles.

The typical coliving space today has 1 staff member per 25-30 residents. Tomorrow's winners will operate at 1:600 or higher (Cushman & Wakefield - Coliving Operations Report 2022).

2. Vertical integration

The asset-light model is dying. Survivors will control more of the value chain.

This doesn't necessarily mean owning real estate outright, but rather:

Forming long-term management agreements with institutional capital partners

Creating internal design and construction capabilities

Developing proprietary furniture systems optimised for their specific model

Building in-house property management expertise

The math is compelling.

"In our analysis of 30+ coliving portfolios across Europe and North America, vertically integrated operators generated 15-19% better operating margins versus operators with fragmented value chains. The differential was most pronounced in technology costs (70% savings) and customer acquisition costs (40% savings)."

SPX Ventures - Coliving Investment Performance (2023)

Quarters (acquired by Habyt) learned this lesson painfully. Their asset-light, rapid expansion left them with inconsistent properties they couldn't efficiently operate.

Meanwhile, The Collective went too far in the other direction, owning buildings outright without the operational efficiency to make the numbers work.

The sweet spot lies somewhere in between.

3. Hyper-specific customer focus

The generic "millennials and Gen Z" target market is dead.

Survivors will focus on specific resident personas with precision:

Blueground targeting high-earning remote workers who stay 2-6 months in a location

Cohabs focusing exclusively on mid-career professionals in specific knowledge industries

Outsite building for remote workers who move between locations quarterly

This specialisation allows for:

Tailored physical design that truly meets user needs

Marketing that can reach customers efficiently (40-60% lower CAC)

Programming and services that create genuine value

Pricing strategies that maximise revenue from the right customers

The generic approaches will be eaten alive by companies with deep customer understanding.

4. Self-sustaining economics

This seems obvious, but it's shocking how many coliving companies chase growth while losing money on every bed.

Survivors will follow three non-negotiable principles:

Location profitability within 12 months

Minimum location-level NOI margins

Scalable corporate overhead

Turning down deals because it takes too long to reach profitability = wise.

That discipline will separate winners from losers.

The coming consolidation wave

The coliving landscape won't disappear overnight.

Instead, I see a three-phase evolution:

Phase 1: The quiet collapse (now)

Smaller operators (under 500 units) silently shutting down

Mid-sized players selling distressed assets at discounts

Venture funding for pure-play coliving models drying up

Phase 2: Strategic consolidation (next 2 years)

Larger operators acquiring competitors for their technology and locations

Institutional real estate players buying coliving platforms at reduced valuations

More traditional multifamily/BTR operators launching coliving products

Phase 3: Category redefinition (next 5 years)

Emergence of 3-5 dominant platforms that transcend "coliving" as a category

Integration of coliving into broader "housing-as-a-service" ecosystems

Clear separation between budget, mid-market, and premium operators

The actionable takeaways

If you're an investor in the space:

Evaluate portfolios based on unit-level economics, not growth metrics

Prioritise technology capabilities over physical amenities

Look for operators with clear paths to operational standardisation

Beware of master lease structures without significant cushion

If you're an operator:

Ruthlessly analyse your unit economics and cut underperforming locations

Invest heavily in technology that reduces operational overhead

Consider partnership models that align incentives with property owners

Develop a genuine technological moat beyond basic property management software

If you're a property owner:

Structure deals with operators that preserve your downside protection

Evaluate operator technology platforms, not just their community promises

Consider revenue-share models rather than pure master leases

Look for operators with proven track records of location-level profitability

The view from 2028

The coliving sector is following a classic innovation curve.

We've moved from the early adopters phase into the trough of disillusionment.

But that doesn't mean the concept is dead.

By 2028, the survivors will have created something far more valuable than today's coliving 1.0 model. They'll have built comprehensive housing platforms that offer:

Truly seamless living experiences across multiple cities

Integrated financial products (rent-to-own, membership-based housing)

Legitimate community value for specific customer segments

Technological infrastructure that makes traditional apartments feel obsolete

The term "coliving" itself may fade, replaced by more specific language that better captures what these platforms actually provide.

Business idea of the week: Coliving asset acquisition platform

The Opportunity: The coming coliving consolidation wave will create a unique moment to acquire distressed properties at significant discounts. Most investors lack the operational expertise to take advantage of this.

The Solution: Build a specialised platform that:

Identifies failing/distressed coliving assets

Acquires them at 30-60% below replacement cost

Implements standardised technology and operations

Consolidates under a refreshed brand with proper unit economics

Why This Works Now:

According to Knight Frank, 22% of coliving operators are already experiencing "severe financial distress"

SPX Ventures data shows that repositioned coliving assets achieve 35-40% higher ROI than ground-up developments

Institutional capital is waiting for stabilised portfolios (10+ properties) but most operators only have 1-3 locations

Differentiation: Focus exclusively on acquiring existing assets rather than developing new ones. This strategy eliminates development risk, accelerates scale, and takes advantage of the coming pricing dislocation.

The bottom line

The coliving industry is facing its moment of truth.

The business model, operational approach, and capital structure that got companies to this point won't carry them forward.

But from this necessary culling, something more sustainable will emerge.

It won't look like the coliving of 2021, and that's a good thing.

For those who recognise this shift and adapt accordingly, the opportunity remains enormous.

Housing is a $3.5 trillion market in the US alone.

Even capturing a small segment of this with a truly differentiated approach creates room for multiple billion-dollar companies.

The winners won't be who most expect. They'll be the operators who recognised early that community is important, but technology, unit economics, and operational excellence are essential.

Until next time,

Zakee

Want to dive deeper?

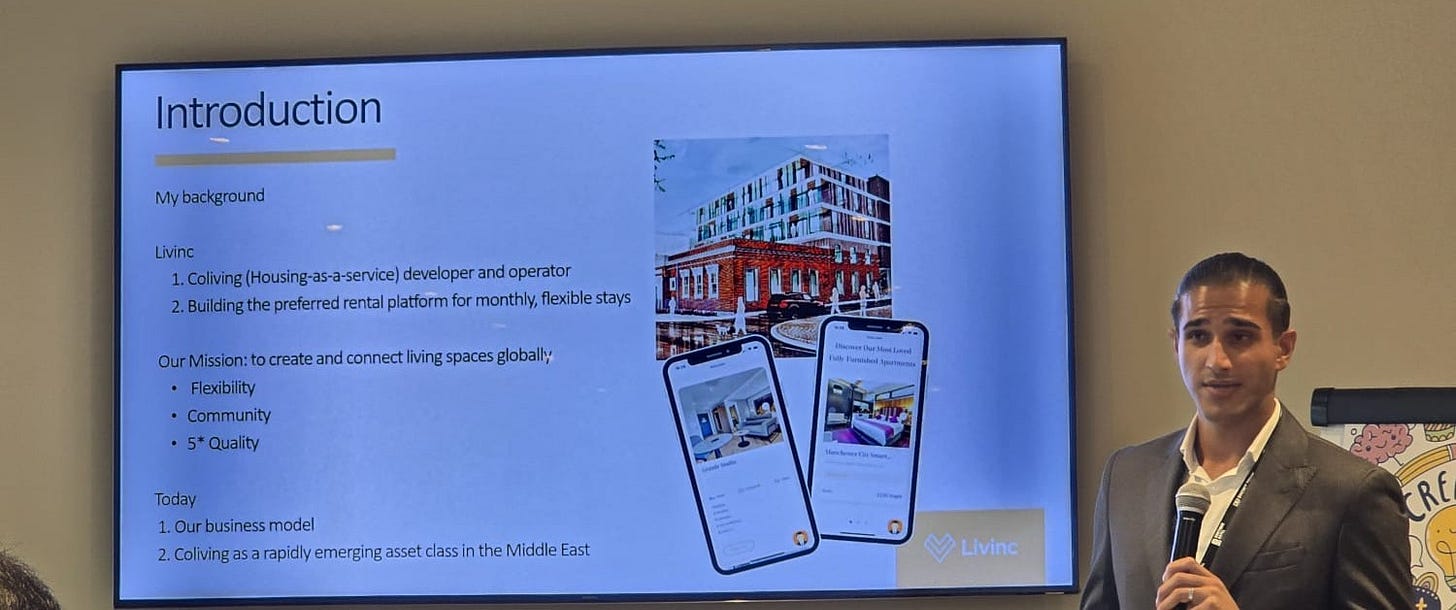

I’ll share my complete coliving presentation from last year's Urban Living Middle East Festival with you.

Comment here and I’ll send you a copy.

I would love to see the presentation

Well written. Please share the deck